Best Payday Loans for Bad Credit Near You

More and more people are taking out short-term loans because they experience temporary financial difficulties. Not having a steady income source, the necessity to fund unexpected expenses or pay urgent bills makes people search for the best online payday loans. According to the FCA research, 7 in 10 UK borrowers find themselves in a financial emergency.

- Is there a way to find the best loans UK?

Although it may be quite challenging to find among hundreds of online finance-related service providers, specialists from VitaLoans know everything about the best bad credit payday loans.

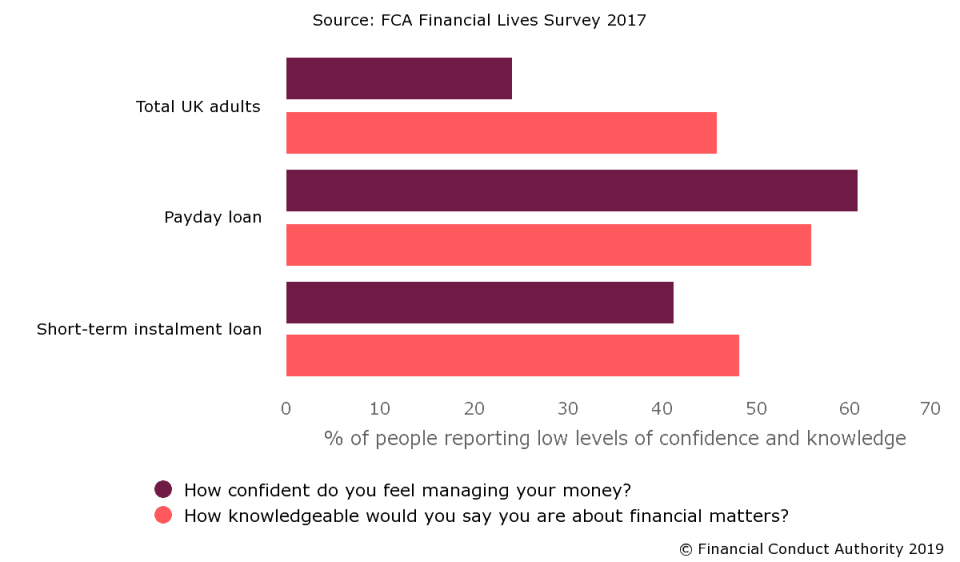

Are you among 61% of UK consumers who don’t feel confident enough in managing their finances or have a lack of financial knowledge at all?

Don’t worry! If you are willing to get the top payday loans UK, we are here to help you. Read our professional reviews of the best-rated companies and choose the most suitable offer from easy online loans lenders.

Compare Payday Loans and Select the Best Option

As it was stated at Finder.com, the average size of the best loans online taken by UK consumers is £260 with 3 in 4 borrowers requesting more than one loan annually. In fact, it is estimated that the average consumer takes out up to 6 best rated payday loans per year.

- Where to search for the best acceptance payday loans?

Generally, consumers go online to look for customer feedback and research for the best loans reviews. However, the reviews and feedback mentioned on the company website can’t guarantee you will remain satisfied with its work. There are numerous pitfalls common borrowers aren’t aware of.

On the other hand, special services that make expert reviews can facilitate this process and help you find the best payday loan companies, not brokers. There are multiple new payday loan companies in the UK that are launched every month. Learn how to distinguish the most trusted one.

How to Select the Most Suitable Loans

- How long does it take to find the best lending solution?

- Where can I compare different loans?

- Can I take a loan for less than a month?

- Why do companies have different rates?

- Who are payday loan brokers?

It’s quite a time-consuming task to select the best online loans today. Usually, it will take a lot of time and effort to look through several companies and compare their services. Still, you can’t be sure that they really provide high-quality service and offer the best payday loans online. For some companies it’s just a matter of business and they don’t really care about the individual financial needs of each borrower.

It’s essential to have an opportunity to compare loans online. You don’t need to place orders at each website before you find the right one. You can request UK loans online with the help of our reviews. Are you looking for the payday loans best rates today? Every borrower can choose any company from our list of the best services. It doesn’t need to be a tedious task to find the best payday loan company. Yet, you should be careful with the amount you borrow and know the terms.

Such short term loans are usually taken for a period of one to thirty-six months. However, you may choose certain lenders who are ready to give out cash for a shorter term. Make sure you read the conditions and understand how much you will need to repay at the end of the repayment schedule. There may be fees for early payment as well as for late or missed payments.

Every online loan service has its own terms and conditions. The rates may differ from one lending institution to another. Thus, it’s important to compare the options and select the most suitable one. The average interest is £24 for each £100 a month. However, the total price depends on the period of borrowing and the sum you need to take.

Unlike direct lenders, such brokers aren’t certified to give out loans. Always look through the information and disclaimers in the fine print on the company website. Avoid scams that charge consumers about £70 for just submitting your application to refer it to a lender.

Select the Best Online Loans for You

As we’ve mentioned above, there are many scams willing just to make more money instead of solving your financial problems. Luckily, here at VitaLoans.co.uk, we’ve facilitated the searching process for you and have already done our professional research.

Here are the reviews of the best instant payday loans. If you don’t want to lose your money or lower the credit score, look carefully and select wisely the best payday lenders in the UK. Comparing the main features of several companies can give you a better understanding of what you need and what you should avoid.

Top-Notch Lending Services in the UK

Every borrower wants to get their issues solved right away without getting even more problems. Access the best UK payday loans following our expert tips and advice.

Reviewing our table of the top-notch lending services can offer you all the necessary information about the loan conditions, credit score and the amount of money that consumers can request from a certain lender. We offer you a free comparison of several services which have been reviewed by our company.

Do you know what features are essential for a trustworthy lending company? First of all, you should pay attention to its website and description of the services it provides. Reasonable terms and affordable rates are also important. Finally, the application process should be quick and safe so that your sensitive data remains secure. Nowadays, the whole process has become so much easier.

Consumers can simply review the most reputable services from our table and select the one that meets their needs and requirements. Using our reliable reviews you won’t get into any trouble and avoid the hassle.

All of our reviews are based on thorough and deep research conducted by our team of specialists. The information provided on this website is unbiased and helpful. Read the reviews online and select the best pay day loans from the most suitable lender. Save your time and get rid of any financial trouble today!