Compare Short Term Loans

There are multiple lending companies and finance-related service providers available on the Internet. All of them claim to be experts in helping people solve their financial trouble and receive quick short term loans. Have you turned to your local bank for cheap short term loans yet? If yes, then you already understand all the tedious paperwork and hassle you need to go through just to submit your loan request. If not, we don’t even recommend you to waste your precious time.

Experts from VitaLoans have done the most challenging task for you. We’ve analyzed the most popular short term loans direct lender services. As a result, our specialists have come up with a list of the best-rated online lending companies.

- Are you willing to obtain short term loans online?

You can get rid of your financial difficulty and fund your needs in just a few clicks. Direct short term loans are closer than you might think.

Short Term Loans - Bad Credit Is No Problem

Are you searching for a perfect solution to help you make ends meet until the next paycheck? Are you in need to repair your car or pay urgent bills? No matter what your reason is, short-term loans may work best for you. Such a solution means a consumer is given a relatively small sum of cash (usually from £100 to £5,000) for any purpose. The repayment schedule for short term loans for bad credit is also flexible and the debt may be repaid within a period of one or several months.

Short term loans bad credit direct lenders offer may come with different terms and interest rates. The general conditions of the loan agreement may differ as well as the total amount you will need to pay off at the end of the repayment schedule. Do you need bad credit short term loans? Don’t worry if you didn’t have the time to boost your credit score. Trouble can often come unexpectedly leaving a person without any savings.

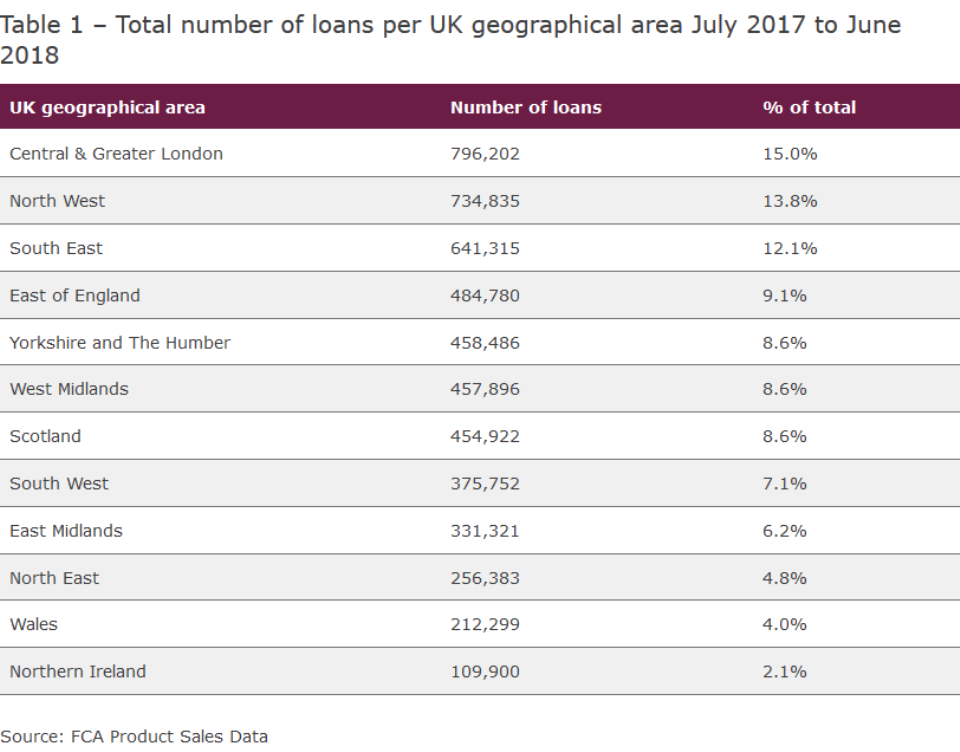

According to the FCA report, London has the highest number of loans – 15% of the market, with the North West and South East having 14% and 12% respectively.

Taking out the best short term loans for bad credit and choosing the company wisely can help every borrower avoid the common pitfalls and solve their issues. Of course, it doesn’t mean that you should count on such lending solution each month. This will only lead you to more debt as the total loan amount will increase monthly. This is a way out only in case you need a quick financial hand and don’t have enough savings to fund the current expenses.

Information Hub for Potential Applicants

Some consumers aren’t sure whether instant short term loans are suitable to help them out. Here are the most widespread questions to help you understand the basics before you make the final decision.

- When is it worth considering small short term loans?

This solution is suitable for getting rid of temporary financial problems such as urgent bills, unexpected small expenses, minor house or car repairs, etc. This is not a long-term option so you will be able to pay the debt off faster. Many borrowers opt for such short term emergency loans. The easy repayment schedule is usually one of the main reasons for their popularity.

- Am I eligible for short term small loans?

To find out whether you can qualify for such a lending solution, the best option is to select one of the top-notch online services and submit your loan request. You will be asked to fill in your personal as well as banking details and the amount you are willing to obtain. After that, the application will be reviewed by third-party lenders. They will perform a soft credit check to distinguish whether they can offer you the money. The loan requests are usually reviewed within a few minutes so that the borrowers don’t need to waste a lot of time.

- How can I apply for a loan?

If a consumer is confident that they need to ask for money from online lending service providers, they are required to fill in their details and necessary information about their income, credit score, etc. The whole application process is generally short and doesn’t take more than 5 minutes. If the loan request is approved by the lender, the money can be transferred to the bank account of the borrower as soon as the next business day.

Short Term Payday Loans Review

There are several options to receive financial help when needed. However, short term loans for poor credit are considered to be one of the best lending solutions. This is a perfect way out for those who urgently need some cash but don’t want to deal with the tedious paperwork and queues in the local banks. Before taking out short term payday loans for bad credit you need to be extremely cautious and consider the following things. Think about the exact amount that is necessary to fund your expenses.

Financial coaches advise not to request more than you need. This is true for consumers whose credit score is not very good. The reason for that is that lenders usually give out such short-term loans with higher interest rates.

So, taking out more means you will need to repay more as well. In case the loan isn’t paid off in time and in full, the borrower risks having more trouble with their credit score. Luckily, here at VitaLoans.co.uk, we’ve done the hard part for you. Our team has already selected the most reliable and expert lending services to obtain short term cash loans and help you solve any issues.

Choose Wisely

Are you thinking of taking out online short term loans? Where can you turn to and how to avoid fraud? Don’t worry! We have all the answers here. You can easily apply for short term loans, compare the top-notch finance-related service providers with the help of our reviews and get funded today. There is nothing wrong with asking for some help if you don’t have enough savings or have nobody to turn to.

"Neither a borrower nor a lender be; for loan doth oft lose both itself and friend, and borrowing dulls the edge of husbandry."

Hamlet, William Shakespeare

Fortunately, there is a better way to avoid the time-consuming process in the banks. Borrowers can apply for same day short term loans from the comfort of their home at any time of the day. Don’t hesitate to make your own choice in favor of the best company on our list. Look at the company overall rating, read through our professional reviews and you will no longer need to spend your precious time trying to compare multiple lenders. Get rid of your financial issues now!