Sites Like Wonga Are Here for You

Are payday loans really useful? The Competition and Markets Authority (CMA) Payday lending market investigation report (2015) reported that 53% of borrowers have used payday loans to cover living expenses. This is one of the easiest and fastest lending solutions when you need the money urgently. People are looking for short-term loans like Wonga because they remember that this was the leader on this market and thousands of people have already turned to Wonga before.

- Are you seeking the best lending solution? Do you need to get some extra cash until the next payday? Payday loans are one of the most widespread solutions when urgent money is necessary.

The original Wonga loans were established in 2009 by Jonty Hurwitz and Errol Damelin. This company started offering small loans until the next payday to borrowers in the UK. It was the first company working exclusively online without the need to provide paper documents from the borrowers. Thus, it has become quickly popular and every consumer wanted to take out a loan here and save time. Nowadays, there are many sites like Wonga that also work online and offer a quick online application form with a fast response.

But at that time, there were no alternatives, so the company gained its popularity. Some people say that the term “Wonga” now is the synonym to the word “money”. The company started having problems since 2014 when it was charged to pay off £2.6 million in borrower compensation. Later in 2017, there was a major data security breach. As a result, thousands of personal details from their borrowers have been stolen by hackers. The number of customer complaints has grown since then, and in August 2018 Wonga has been shut down. But people are still searching for the best alternative to Wonga.

Select the Best Alternative Today

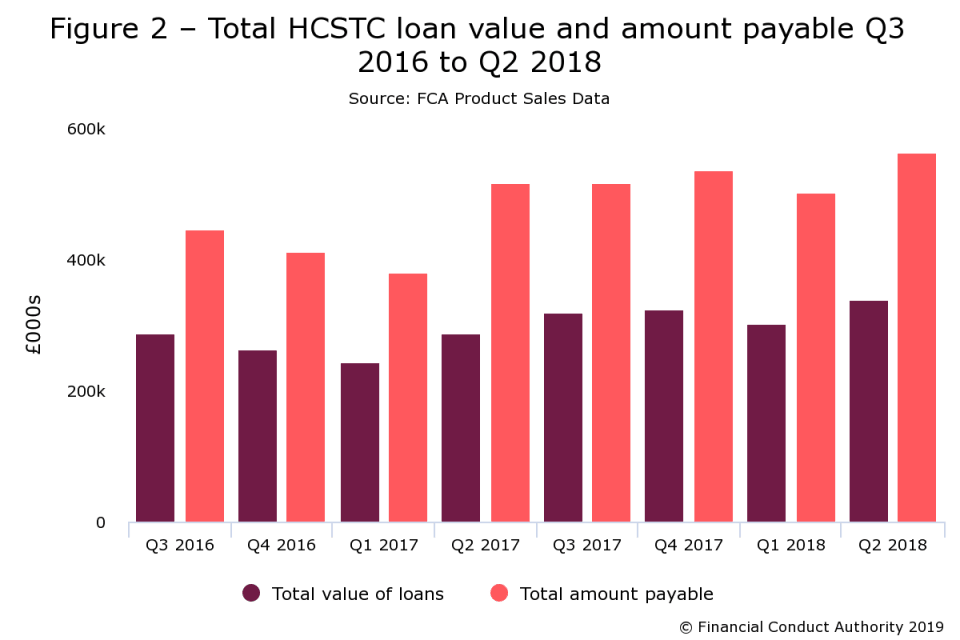

Cash loans are extremely popular among people in many countries these days. FCA.org.uk states that consumers borrow almost £1.3 billion annually and have to repay more than £2 billion. This happens because there are the interest rate and extra fees that also need to be taken into account. Instant payday loans like Wonga all have a certain interest rate which may differ from one lending institution to another.

You shouldn’t believe those companies like Wonga that claim to have no credit check – it’s not true as every lender will perform at least a soft credit check to make sure you don’t present high risks as a potential borrower and will be able to repay the debt in full. Creditors aren’t willing to deal with high-risk consumers and the unemployed. If you don’t have a steady source of income, you have very little chance of getting approved for a loan. Keep this in mind when you submit your loan request to the loan websites like Wonga.

The report by the Consumer Finance Association that was produced by the Social Market Foundation has stated that there has been a significant change in the type of consumers who take out short-term loans. Those who took out a loan over the last few years were more likely to be in employment than those who took out loans back in 2012. About 96% of employees and self-employed borrowers have taken a small personal loan at least once. Nowadays, it’s almost impossible to get approved for a loan if the borrower doesn’t have any employment.

More than that, the Financial Conduct Authority (FCA) has released a report stating that payday loans are increasing in demand since 2016 again, even though there are fewer creditors now (and the trusted ones like Wonga have been shut down). During 2018 consumers have taken out £1.3 billion in 5 million loans across the country. This proves the fact that the demand for payday loans is increasing. So, people should be accountable for this decision and understand that they need to find top-rated creditors who will help them.

Sites Similar to Wonga that Are Open Today

If you are currently searching for a site exactly like Wonga you want to find a reputable and trusted company that won’t let you down. You should stick to the FCA-authorized lending services that have the following options. All the companies present here on our review list have been tested by our managers and have proven to work honestly and provide high-quality lending services to UK consumers.

According to the Finder.com, 83% of payday loan borrowers have opted for an online loan. It means that the days have gone when consumers had to wait several weeks and gather numerous papers to attempt to get approved for a loan from a traditional bank. Banks need tedious paperwork and a long waiting list, while high acceptance payday loans direct lenders are working here and now to help each consumer solve their temporary issues. They don’t ask about the purpose or the loan but just review your main details and make their decision.

Nowadays, people are willing to get access to fast money. These lenders like Wonga from our list below offer payday loans even for bad credit. So, if you don’t have the time to improve your credit score, you can still apply for these sites similar to Wonga and receive fast financial help.

Solve Your Temporary Issues

Some companies claim to provide various lending solutions but usually have high interest rates or additional charges. Consumers are looking for instant loans like Wonga because they want to avoid scams and frauds.

- We advise you to review the top-notch finance-related service providers and make sure you find the information about their interest rates, loan terms, the repayment schedule, early repayments, loan freeze, and grace period on missed or late payments, etc.

Whatever additional questions you may have, feel free to contact the customer support of these websites that give loans similar to Wonga. Only reliable companies have a 24/7 customer support team that is working for clients. Once the loan request form is submitted online, the team will try to match a consumer with their database of direct lenders.

Don’t worry, they deal even with borrowers whose credit is not excellent. They understand how hard it is to maintain good credit, especially when a financial emergency hits you and you don’t have enough time to boost the credit history. Look through the list of the best companies here and select the one with the most affordable terms and rates.